[ad_1]

Hreni/iStock via Getty Images

Welcome to the nickel miners news for May. The past month saw the nickel producers reporting strong Q1 2022 financial results boosted by higher nickel prices. The juniors also continue to make good progress.

Nickel Price News

As of May 31, the nickel spot price was USD 12.63, significantly lower than USD 15.10 last month. LME shows the price at USD 29,925/tonne. Nickel inventory at the London Metals Exchange [LME] was slightly lower the past month at 72,000 tonnes (72,642 tonnes last month).

Nickel spot price chart – Current price = USD 12.63/lb

Mining.com

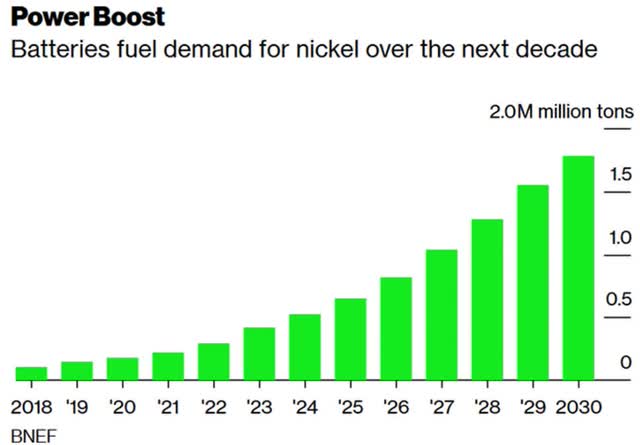

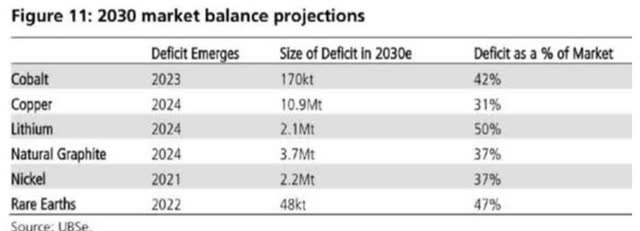

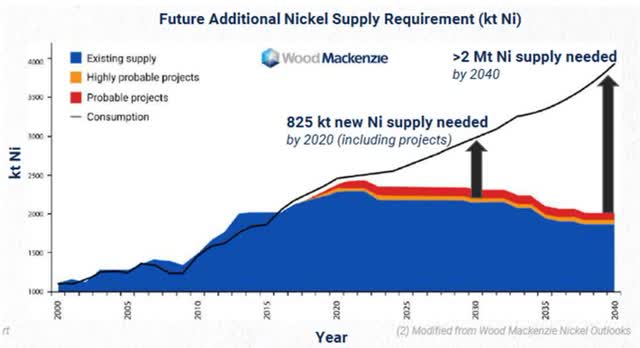

Nickel Demand Vs. Supply Charts

Battery nickel demand set to surge over tenfold this decade as the EV boom takes off (2020 chart)

BloombergNEF

UBS forecasts Year battery metals go into deficit (2021 chart)

UBS

Nickel demand v supply forecast – Deficits widening from 2022 onwards

Wood Mackenzie

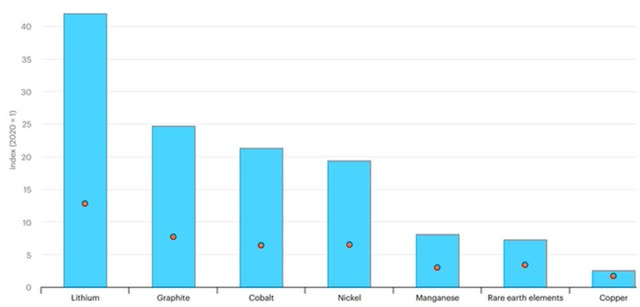

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, and Copper 2x to 3x

IEA

Nickel Market News

On May 9, Electrek reported:

Tesla explains its approach to sourcing lithium, nickel, and cobalt directly from mines in impressive detail… The automaker says that it had directly sourced over 95% of the lithium hydroxide, 50% of the cobalt, and more than 30% of the nickel used in its high-energy density cells (NCA and NCM) in 2021. The rest came from deals between the battery cell manufacturers and their own material suppliers. As we previously reported, Tesla also released a list of the nine mining companies that are supplying those minerals.

On May 10, Simon Moores of BMI tweeted:

Big update to Defense Production Act: US now expands definition of “domestic source” of battery raw materials to include UK, Australia and Canada You do get a feeling a new industrial trade bloc is forming for #EV – lithium ion battery supply chain.

On May 12, Reuters reported:

Pentagon asks Congress to fund mining projects in Australia, U.K… that process strategic minerals used to make electric vehicles and weapons, calling the proposal crucial to national defense. The request to alter the Cold War-era Defense Production Act… Congress may reject or accept the proposed changes when it finalizes the bill later this year… Relying only on domestic or Canadian sources, the Pentagon said, “unnecessarily constrains” the DPA program’s ability to “ensure a robust industrial base.”

On May 24, S&P Global reported:

Nickel market to swing to mild surplus persisting beyond 2022: Nornickel… Global primary nickel production may grow 19% in 2022 to 3.21 million mt and the nickel deficit of 2021 should swing to a mild surplus of about 40,000 mt in 2022, albeit comprising mostly low-grade metal, according to Russia’s Nornickel. Nornickel made allowance though that the abnormal price volatility, the energy supply crunch, new COVID-19 lockdowns, and potential supply disruptions amid extremely tight nickel exchange inventories — equating to less than 10 days of global consumption — may impact its forecast significantly.

On May 25, Mining Weekly reported:

Severe global battery shortage likely post 2025, GlobalData forecasts. Extraction of raw materials will not meet soaring battery demand unless capital markets change course in the face of environmental, social and governance pressures and invest heavily in new mines, says business data and analytics company GlobalData in its ‘Batteries – Thematic Research’ report…. An emerging challenge for the next decade will be whether extraction of natural resources and raw materials such as lithium, nickel, cobalt and graphite can meet the soaring demand for batteries.

On May 29, Bloomberg reported:

Goldman says bull market in battery metals is finished for now. Cobalt, lithium, nickel to fall in the next two years: Goldman. A new bull market may start in the second half of this decade… Nickel is likely to rise almost 20% over the rest of this year to $36,500 a ton before “fundamental pressures” drive it lower again, the analysts forecast. Still, prices could soar again after 2024.

Nickel Company News

Producers

Vale SA (VALE)

Vale plans a US$1.7B Voisey’s Bay expansion plan to boost their nickel production. Construction began in 2018 and is expected to be complete by 2022. You can read more here.

On May 6, Seeking Alpha reported:

Vale signs long-term nickel supply deal with Tesla… Under the deal, Tesla (TSLA) will purchase nickel from Vale’s mines in Canada, which produced 76K metric tons of nickel last year; financial details are not provided.

On May 6, Vale announced:

Vale confirms supply deal with Tesla for low-carbon nickel… Vale’s target is to deliver 30% to 40% of Class 1 nickel sales into the fast-growing electric vehicle industry.

On May 16, Vale announced:

Vale completes share buyback program launched in October 2021 and starts new buyback program. Vale S.A. (“Vale”) informs that it concluded the buyback program for Vale’s common shares, started in October 2021, with 200 million shares repurchased, at an average price of US$ 17.56/share, totaling US$ 3,513 million. Vale also informs that on this date it started the new buyback program, which is limited to the maximum acquisition of 500 million common shares and their respective ADRs. The new program will be implemented over the next 18 months, starting from the date of the Board’s deliberation, which took place on April 27, 2022…

On May 17, Vale announced:

Vale receives third-party assurance for additional low-carbon nickel products. About 83% of Vale’s Class 1 nickel now has an independently verified carbon footprint, underscoring Vale’s commitment to delivering low-carbon metals while ensuring responsible carbon data management and transparency…

Norilsk Nickel [LSX: MNOD] (OTCPK:NILSY)

On April 25, Norilsk Nickel announced: “Nornickel and Rosatom sign cooperation agreement…”

On April 29, Norilsk Nickel announced: “Nornickel develops first operations centre at smelter…”

On May 12, MMC Norilsk Nickel announced:

Nornickel received permission to retain its depository receipts programme… notifies its American depositary receipt (ADR) holders that the Government Commission on Control of Foreign Investments in the Russian Federation (the Commission) has approved the Company’s request to maintain the circulation of its ADRs outside of the Russian Federation for a duration of one year (since the approval was granted) until April 28, 2023…. Nornickel welcomes the decision of the Commission as it provides time to assess available opportunities and investigation of necessary steps to support the Company’s long-term investment attractiveness.

On May 24, Seeking Alpha reported:

Nornickel says no material impact on palladium, nickel sales via sanctions… and maintained its production guidance for 2022, despite the war in Ukraine that has broadly affected commodity markets.

BHP Group [ASX:BHP] (BHP)

BHP’s Nickel West (includes the Mt Keith nickel mine in Australia) has a Measured and Indicated Resource of 4.1Mt contained nickel with a Total Resource contained nickel of 6.3Mt, with an average grade of 0.58% Ni in sulphide ore. Nickel West produced 80 kt of nickel in FY 2020. Stage 1 production of the Kwinana Nickel Refinery is aimed to be 100ktpa nickel sulphate.

No nickel news for the month.

BHP’s Nickel West operations

BHP Group

Glencore [HK:805] [LSE:GLEN] (OTCPK:GLCNF)

On April 28, Glencore announced: “First quarter 2022 production report.” Highlights include:

- “Own sourced nickel production of 30,700 tonnes was 5,500 tonnes (22%) higher than Q1 2021, primarily reflecting Koniambo operating both production lines in 2022….

Production guidance

Changes to guidance mainly reflect: Nickel: up 3kt (3%) – Q1 quarterly performance.”

Jinchuan Group [HK:2362]

No nickel-related news for the month.

Sumitomo Metal Mining Co. (OTCPK:SMMYY)

On April 25, Sumitomo Metal Mining Co. announced: “Discontinuation of SMM’s feasibility study on the Indonesian Pomalaa Project…..”

On May 10, Sumitomo Metal Mining Co. announced:

FY2022 capital expenditure and total investment plans. Sumitomo Metal Mining Co., Ltd. [SMM] plans a total 140.8 billion yen of capital expenditures on a consolidated basis during the fiscal year 2022 (April 1, 2022 — March 31, 2023). The total investment represents a 118% increase from that of FY2021… Expansion of production capacity for cathode materials for secondary batteries for electric vehicles: 13.5 billion yen (total outlay: 47billion yen).

On May 18, Sumitomo Metal Mining Co. announced: “FY2021 progress of business strategy.”

Anglo American [LSX:AAL] (OTCQX:AAUKF)

No nickel news for the month.

ERAMET (OTCPK:ERMAY)

On April 28, ERAMET announced: “ERAMET: Strong growth in Q1 2022 turnover.” Highlights include:

-

“Very good operational performance of mining activities: +17% of manganese ore produced in Gabon (vs. Q1 2021), +16% of volumes sold externally. +10% of nickel ore produced in New Caledonia, +46% of exported volumes. +74% of nickel ore produced in Indonesia. +16% of mineral sands produced in Senegal.

-

Particularly favourable price environment, in a context of strong supply tension in all of ERAMET’s markets, accentuated by the war in Ukraine.

-

Turnover of €1.2bn in Q1 2022 in the new ERAMET scope, up by nearly 80% from Q1 2021, including a price effect of +64%, and a currency effect of +10%.

-

2022 Outlook: Export and production volume targets confirmed… Impact of higher selling prices expected to be partially offset by the strong increase in input costs, particularly freight, energy, and metallurgical coke. Based on the consensus of the above mentioned price forecasts, forecast EBITDA revised upwards to more than €1.5bn in 2022 (vs. approximately €1.2bn initially). The very uncertain geopolitical and health context could however weigh on demand, notably in H2.”

Sherritt International (OTCPK:SHERF) [TSX:S]

On May 11, Sherritt International announced: “Higher nickel and cobalt prices drive Sherritt’s strong first quarter results.” Highlights include:

-

“Advanced with project scoping, development of timelines and capital cost requirements for Sherritt’s growth strategy aimed at increasing finished nickel and cobalt production by 15 to 20% over production in 2021, which should result in an increase in annual nickel production of approximately 4,700 to 6,200 tonnes (100% basis) once all projects are completed in 2024. Progress in Q1 2022 included continued construction of the slurry preparation plant, near completion of a feasibility study for a leach plant sixth train at Moa, and the start of basic engineering on de-bottlenecking projects at the Fort Site and the basic engineering on upgrading of the acid plant at Moa.

-

Net earnings from continuing operations were $16.4 million, or $0.04 per share, compared to a net loss of $1.9 million, or $nil per share, in Q1 2021.

-

Adjusted EBITDA(1) was $58.5 million, Sherritt’s highest since Q3 2014. The improved Adjusted EBITDA was driven by higher nickel, cobalt, and fertilizer market prices, improved operating performance, and ongoing efforts to reduce costs, partly offset by $26.6 million of share-based compensation expense due to the impact of Sherritt’s 103% rise in the value of its shares.

-

Sherritt’s share of finished nickel and cobalt production at the Moa Joint Venture (Moa JV) were 3,875 tonnes and 446 tonnes, respectively…….”

On May 11, Sherritt International announced:

Sherritt announces modified Dutch auction to purchase secured notes and fixed price tender offer to purchase junior notes for aggregate $50 million.

IGO Limited [ASX:IGO] (OTCPK:IIDDY) (formerly Independence Group)

On April 29, IGO Limited announced: “Quarterly report period ended 31 March 2022. IGO delivers continued strong performance and remains on track to achieve full year guidance.” Highlights include:

-

“Group sales revenue of A$246M and underlying EBITDA of A$233M for the Quarter, assisted by high metal prices and increased net profit from TLEA.

-

Cash on balance sheet of A$440M following payment of A$171M income tax and A$38M dividend in the Quarter – with no debt.

-

Share of net profit from TLEA increased to A$61M, up A$52M quarter on quarter.

-

Nova on track to deliver full year production guidance with cash costs tracking better than guidance……

-

A ‘last and final’ offer for Western Areas has been endorsed by Western Areas Board and is due to complete in June 2022, subject to shareholder approval.”

Panoramic Resources [ASX:PAN] (OTCPK:PANRF)

Panoramic’s Savannah mine and mill has a forecast life of mine average annual production rate of 10,800t of nickel, 6,100t of copper, and 800t of cobalt metal contained in concentrate.

On May 11, Panoramic Resources announced: “C$1.5M payment for Thunder Bay North received.”

On May 20, Panoramic Resources announced: “Savannah Nickel surface drilling program underway,” Highlights include:

-

“Surface exploration diamond drilling has commenced at Savannah testing high priority strong electromagnetic (EM) conductors at: Stoney Creek. Northern Ultramafic Granulite.

-

Minimum initial program of three holes for 2,000m to be completed in June 2022.

-

Further downhole EM surveying planned following completion of the drilling.

-

Assay results from the program expected during the September quarter 2022.”

Nickel Mines Ltd. [ASX:NIC] (OTCPK:NICMF) – Plan to change name to Nickel Industries Limited

On May 2, Nickel Mines Ltd. announced:

Proposed change of company name. The Directors of Nickel Mines Limited (‘Nickel Mines’ or ‘the Company’) have resolved, subject to shareholder approval, to change the Company’s name to Nickel Industries Limited, with this proposal to be put before shareholders as a special resolution at the Company’s upcoming AGM on 31 May 2022.

On May 3, Nickel Mines Ltd. announced:

Angel Nickel receives ‘IUI’ commercial sales licence. The Directors of Nickel Mines Limited (‘Nickel Mines’ or ‘the Company’) are pleased to advise that its 80% owned Angel Nickel Project (‘Angel Nickel’ or ‘ANI’) has now received its Izin Usaha Industri (‘IUI’ or ‘Industrial Business Licence’) enabling it to commence commercial sales. The IUI has been issued to the Project’s Indonesian operating entity PT Angel Nickel Industry and first sales from ANI will occur later this month. As at the end of April ANI had produced 2,975 tonnes of nickel metal (in NPI) with three of the Project’s four lines having entered commissioning. All producing lines are continuing to ramp-up production levels in line with expectations, with all production to date having been stockpiled awaiting the receipt of the IUI licence. The Project’s fourth line is scheduled to commence commissioning by mid-May.

On May 4, Nickel Mines Ltd. announced: “Ownership interest in Oracle Nickel increased to 30%.”

On May 16, Nickel Mines Ltd. announced:

Acquisition of the Siduarsi Nickel-Cobalt Project. The Directors of Nickel Mines Limited (‘Nickel Mines’ or ‘the Company’) are pleased to announce that the Company has signed a binding definitive agreement (‘Definitive Agreement’) for the staged acquisition of a 100% interest in the Siduarsi Nickel-Cobalt project (‘Siduarsi’) in Papua province, Indonesia. This follows on from the binding Memorandum of Agreement (‘MoA’) signed in September 2021 (refer ASX announcement on 2 September 2021, ‘MoA Signed for Siduarsi Nickel-Cobalt Project’)…..

On May 16, Nickel Mines Ltd. announced: “Angel nickel’s fourth rkef line commences commissioning.”

Nickel 28 Capital Corp. [TSXV:NKL] [GR:3JC] (OTCPK:CONXF)

On May 9, Nickel 28 announced: “Nickel 28 releases Ramu Q1 2022 operating performance.” Highlights include:

-

“Ramu Q1 2022 production of 8,756 tonnes of contained nickel in MHP.

-

Ramu Q1 2022 nickel sales of 3,336 tonnes of contained nickel.

-

LME average nickel price of $11.97/lb. in Q1 2022, a 50% increase from the same period last year and a 33% increase from Q4 2021.

-

Actual cash cost, net of by-product credits of $1.48/lb. of nickel produced as MHP, a cost reduction of 12% from Q1 2021.”

Mincor Resources [ASX:MCR] (OTCPK:MCRZF)

Owns the Kambalda Nickel Operations (includes the Cassini nickel sulphide mine), just south of Kambalda in Western Australia. First nickel concentrate is set to begin in Q2 2022.

On April 29, Mincor Resources announced:

First production locked in under enhanced off-take agreement. BHP Nickel West and Mincor agree amendments to the existing off-take agreement which result in first production being locked in for May 2022, and first cash-flow in June 2022…

On May 9, Mincor Resources announced:

Mincor celebrates first ore through BHP Kambalda concentrator. BHP has commenced processing the first parcel of Mincor’s high-grade nickel ore.

Other nickel producers

First Quantum Minerals [TSX:FM] (OTCPK:FQVLF), Franco-Nevada [TSX:FNV] (FNV), MMG [HK:1208], South32 [ASX:S32] (OTCPK:SOUHY) (OTCPK:SHTLF), Lundin Mining [TSX:LUN] (OTCPK:LUNMF), Nickel Asia Corporation [PSE:NIKL], Platinum Group Metals [TSX:PTM] (PLG).

Nickel juniors

Horizonte Minerals Plc [TSX:HZM] [AIM:HZM] (OTCPK:HZMMF)

Horizonte is developing its 100% owned Araguaia Nickel Project (Araguaia) as Brazil’s next major ferronickel mine.

On May 11, Horizonte Minerals Plc announced:

Earthworks contract award at Araguaia. Horizonte Minerals Plc (AIM: HZM, TSX: HZM), the nickel development company focused in Brazil, is pleased to announce that it has awarded the earthworks contract for the construction of its 100%-owned Araguaia ferronickel project (“Araguaia” or the “Project”) to Copa Construção S.A. (“Copa”).

On May 16, Horizonte Minerals Plc announced: “Q1 financial results for the three months ended 31 March 2022.” Highlights include:

-

“Closing of US$633 million funding package for construction of Araguaia nickel project.

-

Awarded a number of key construction contracts including furnace, EPCM, and earthworks.

-

Further additions to the project execution team.

-

Approved start of construction in late January 2022 with earthworks contractor mobilised to site in May to maximise productivity during the dry season.

-

Project development work is running in line with the project execution schedule with a significant ramp up in activity expected over the coming months as we move into the dry season.

-

Company to adopt reporting currency to USD (previously GBP) ahead of first revenue in 2024.

-

Strong balance sheet with cash and cash equivalents US$252m at 31 March 2022.”

On May 19, Horizonte Minerals Plc announced:

Breaking ground at the Araguaia Nickel Project Horizonte Minerals Plc (AIM: HZM, TSX: HZM), the nickel development company with assets in Brazil, is pleased to announce that the Company has officially commenced construction and broken ground at its flagship Araguaia Nickel Project (‘’Araguaia’’ or the “Project”)… Tier 1 project has a 24-month construction timeframe with Stage 1 (first line) target production of 14,500 tpa of nickel. Araguaia will be a large high-grade scalable, low-cost producer, with a long mine life and will be a low-carbon source of ferronickel.

On May 20, Horizonte Minerals Plc announced: “Horizonte publishes 2021 Sustainability Report.

Poseidon Nickel [ASX:POS] (OTCPK:PSDNF)

On April 29, Poseidon Nickel announced: “Quarterly report 31 March 2022.” Highlights include:

Resource Definition Drilling

Metallurgy

“Metallurgical test work on various ore sources, nickel recoveries and potential concentrate specifications advancing.

Regrind test work on Black Swan Disseminated samples confirms higher nickel grade can be achieved in the final concentrate.”

Bankable Feasibility Study (BFS)

“Engineering studies well advanced.

Additional drilling, work scope changes and industry wide pressures have pushed the BFS delivery out a few months to September 2022.”

Pure Battery Technologies (PBT) Kalgoorlie pCAM refinery

“PBT, in partnership with Poseidon, received a $119.6 million Modern Manufacturing Initiatives Grant from the Federal Government.

Excellent pressure oxidation nickel/cobalt leach extraction achieved on a flotation concentrate produced using a blend of the serpentinite and talc carbonate ores.

PBT and Poseidon negotiating a definitive agreement to work together going forward….”

Corporate

Amur Minerals Corp. [LSE:AMC] [GR:A7L] (OTCPK:AMMCF)

On May 9, Amur Minerals Corp. announced: “Proposed sale of the Kun-Manie Project for US$105 million.” Highlights include:

-

“The total consideration for the Transaction is US$105 million to be completed in a series of payments. The Transaction consideration is payable in US$.

-

The divesture price represents premiums of 220% to the Company’s market capitalisation of 5 May 2022 (£26.2 million) and 330% to the current Kun-Manie book value of US$24.4 million as at 30 June 2021 in Amur’s interim financials. The closing share price on 5 May 2022 was 1.91 pence per share.

-

A Fair Market Value (“FMV”) of AO KM was derived by Medea Natural Resources (“MNR”) with a range from US$106 million to US$131 million based on an assessment of international transactions for similar sized nickel equivalent projects. Given current volatile market conditions, and that the project is located within Russia, the Transaction falls at the lower limit of the independently derived FMV.

-

In addition to shareholder approval of the Transaction at a General Meeting scheduled for 25 May 2022, completion of the Transaction requires the approval by a newly created Russian Federation government commission per Order 81 dated 1 March 2022 (which specifically addresses change of control of western held assets) and the consent of the Federal Antimonopoly Service of Russia.

-

The Company and its financial auditor (“BDO”) now consider the Kun Manie project to be an asset held for sale from an accounting perspective until a change of control is completed.“

Payment Terms

The divestiture price of US$105 million will be paid as follows:

“Consideration of US$75 million payable by the Buyer to Amur as follows: US$15 million upon Completion of the Transaction (to occur within 60 days of signing the SPA). US$10 million within 12 months of the date of the SPA. US$50 million within 48 months of the date of the SPA.

Amur has also agreed to assign to the Buyer the benefit of all loans owed by Kun-Manie to Amur in consideration for US$30 million, payable in ten annual installments of US$3 million commencing on the anniversary of the date of completion in 2027.“

Talon Metals [TSX:TLO] (OTCPK:TLOFF) Tamarack – (JV with Rio Tinto)

Tamarack is a high-grade nickel-copper-cobalt project located in Minnesota, USA, with considerable exploration upside. Talon Metals owns a 51% project share, with potential to further earn-in to a 60% share by 2026.

On May 13, Talon Metals announced: “Talon Metals reports results for the quarter ended March 31, 2022.”

On May 18, Talon Metals announced:

US EV battery supply chain: Talon Metals releases record length of high-grade nickel mineralization at the Tamarack Nickel Project. Henri van Rooyen, CEO of Talon said: “With the Tesla supply agreement in hand, and the goal of first production by 2026, the 4 drill rigs at site are now completely focused on infill drilling within the main zone with the goal of upgrading the high-grade resource from the ‘inferred’ category to the ‘indicated’ category. We are on target to complete our infill program for our Pre-Feasibility Study by the end of May, and then the rigs will be deployed outside the main zone with the goal of making new discoveries at the Tamarack Nickel Project.”

Garibaldi Resources [TSXV:GGI] [GR:RQM] [LN:OUX6] (OTCPK:GGIFF)

No nickel-related news for the month.

OZ Minerals [ASX:OZL] (OTCPK:OZMLF)

Owns the West Musgrave nickel-copper project in Western Australia as well as several other mines.

On May 17, OZ Minerals announced: “OZ Minerals announces option to acquire Kalkaroo copper project in South Australia.” Note: A copper-gold-cobalt Project.

St George Mining Ltd. [ASX:SGQ] [GR:SOG]

The Cathedrals, Stricklands and Investigators nickel-copper discoveries (at Mt Alexander) are located on E29/638, which is held in joint venture by Western Areas Limited (25%) and St George (75%). St George is the Manager of the Project with Western Areas retaining a 25% non-contributing interest in the Project (in regard to E29/638 only) until there is a decision to mine.

On April 29, St George Mining Ltd. announced: “Quarterly activities report for the period ended 31 March 2022.”

On May 3, St George Mining Ltd. announced: “Major step-up in exploration underway for St George. Substantial exploration programmes planned to test new high-priority targets across four projects, all located in Western Australia.” Highlights include:

Mt Alexander Nickel-Copper-PGE Project, in the Goldfields:

“Seismic and EM surveys starting in May will assist in defining potential for massive Ni-Cu sulphides in untested areas of the strongly mineralised Cathedrals Belt and adjacent. Mt Alexander Greenstone Belt.

Diamond and RC drill programme to follow geophysical surveys.”

Ajana Project, in the Mid West:

“Recently completed airborne magnetic survey has defined a very unusual, 20km long interpreted intrusion within the Northampton mineral field which hosts many historic base metal mines.

Drilling of the intrusion – considered prospective for Ni-Cu-PGEs – is planned as soon as access is available.”

Broadview Project, in the Wheatbelt:

“Initial auger soil results from two large interpreted mafic intrusions support the potential for Ni-Cu-PGEs within a similar setting to Chalice Mining’s Julimar discovery.

Airborne electromagnetic [EM] survey planned ahead of initial drilling.”

Sama Resources [TSXV: SME] [GR;8RS] (OTCPK:SAMMF)

On May 17, Sama Resources announced:

Sama enters into Share Purchase Agreements for sale of 5,625,000 shares in SRG Mining Inc… After the closing date, Sama will then own 19,180,377 common shares of SRG, representing 16.875% of the issued and outstanding shares of SRG.

On May 26, Sama Resources announced: “Four holes drilled at the newly discovered Grata prospect in Ivory Coast returned thick intersections of nickel-copper-palladium mineralization including holes GR-08 and GR-11 with 298 meters and 212 meters respectively. Starting June 01, five drilling rigs will be in operation at the Grata and Samapleu deposits.” Highlights include:

-

“GR-06B: returned 60.15 m at 0.36% Ni, 0.40% Cu, 0.53 gpt Pd including 7.70m at 1.28%Ni, 1.45% Cu and 1.92 gpt Pd.

-

GR-06C: returned 116.15 m at 0.26% Ni, 0.25% Cu, 0.62 gpt Pd including 9.05m at 0.81%Ni, 0.84% Cu and 1.03 gpt Pd.

-

GR-08: returned 297.64m at 0.24% Ni, 0.20% Cu, 0.23 gpt Pd including: 2.85m @ 1.68%Ni, 1.28% Cu and 1.12 gpt Pd. 4.25m @ 0.82%Ni, 0.55% Cu and 0.56 gpt Pd. 2.65m @ 1.47%Ni, 1.82% Cu and 1.19 gpt Pd

-

GR-11: returned 212 m at 0.28% Ni, 0.30% Cu & 0.32 gpt Pd: 8.20m @ 0.84% Ni, 1.10% Cu & 1.24 gpt Pd. + numerous narrow massive and semi-massive stringers.

-

Results are pending for 11 holes drilled at Grata since January 2022.”

Premium Nickel Resources Corporation [TSXV: “stock ticker to be named soon”] – includes the merged North American Nickel company [TSXV:NAN]

On April 28, North American Nickel announced:

North American Nickel Inc. closes previously announced “Best Efforts” private placement of $10.1 million of subscription receipts.

Canada Nickel Company [TSXV:CNC] (OTCQB:CNIKF)

On May 10, Canada Nickel Company announced: “Canada Nickel announces new nickel discovery at Reid with larger footprint than Flagship Crawford Property Main Zone; Provides update on regional exploration.” Highlights include:

-

“Reid Property – second hole of new discovery intersected dunite across entire 354 metre core length including an 84 metre highly mineralized interval.

-

All 21 holes drilled at Deloro, Reaume, and Nesbitt properties intersected target mineralization.”

On May 12, Canada Nickel Company announced: “Canada Nickel takes important step in Crawford Nickel Project permitting process.”

Investors can view a CEO video here, or a CEO interview here on Trend Investing.

Giga Metals [TSXV:GIGA] [FSE: BRR2] (OTCQX:HNCKF)

On May 2, Giga Metals announced:

Giga Metals resumes Brazilian drill program. Drilling has resumed on hole 4 of the planned 10-hole (1500m combined meterage) programme. Progress and results will be reported in due course.

On May 19, Giga Metals announced: “Giga Metals releases drill results from 2021 program.” Highlights include:

-

“Nine NQ resource infill holes totaling 4,214 metres within the Horsetrail and Northwest zones of the Turnagain deposit.

-

Six HQ geotechnical holes totaling 2,082 metres sited on the margins of Horsetrail and Northwest zones of the Turnagain deposit to support pit engineering design.

-

Seismic refraction survey in Flat Creek Valley in support of tailings management engineering design.”

Ardea Resources [ASX:ARL] (OTCPK:ARRRF)

On April 28, Ardea Resources announced:

Quarterly operations report for the quarter ended 31 March 2022. Ardea remains debt free, with a tight capital structure. During the Quarter, the Company completed a strongly oversubscribed $21.5M Placement (before costs) and had $24.1M cash-at-bank, at the end of the March 2022 Quarter.

On May 16, Ardea Resources announced: “Confirmation of high-grade nickel-cobalt from Goongarrie South metallurgical drilling.” Highlights include:

Intercepts… include:

- “AGSD0032 26m at 1.33% nickel and 0.029% cobalt from 22m including 20m at 1.53% nickel and 0.034% cobalt from 28m and 26m at 0.75% nickel and 0.032% cobalt from 66m including 8m at 1.10% nickel and 0.048% cobalt from 68m.

- AGSD0034 58m at 1.03% nickel and 0.065% cobalt from 48mincluding 38m at 1.21% nickel and 0.087% cobalt from 66m.”

On May 26, Ardea Resources announced: “Confirmation of high-grade nickel-cobalt from Goongarrie Hill metallurgical drilling.” Highlights include:

Intercepts at 0.5% nickel and 1% nickel cut-off grades include:

“AGHD0003 38m at 0.85% nickel and 0.057% cobalt from 2m, including 18m at 1.12% nickel and 0.095% cobalt from 4m.

AGHD0005 18m at 1.16% nickel and 0.059% cobalt from 2m, including 14m at 1.22% nickel and 0.067% cobalt from 6m.”

Centaurus Metals Limited [ASX:CTM] (OTC:CTTZF)

Centaurus Metals is an Australian-based minerals exploration company focused on the near-term development of the Jaguar Nickel Sulphide Project in Northern Brazil.

On April 29, Centaurus Metals Limited announced:

March 2022 quarterly activities report. Exceptional new drilling results at Jaguar highlight strong growth potential, with Definitive Feasibility Study, and permitting advancing rapidly; Jaguar selected as a Strategic Minerals Project by the Brazilian Government; $75M capital raising sets strong foundation for Centaurus’ next chapter of growth.

On May 16, Centaurus Metals Limited announced: “Jaguar resource definition drilling delivers outstanding new results of up to 46.0m at 2.17% nickel. Successful in-fill drilling continues to de-risk the Project by increasing confidence in the shallow open pit mineralisation that will underpin early payback of the planned mining operation.” Highlights include:

-

“Significant shallow results received from ongoing in-fill drilling at the Jaguar Central (JC), Jaguar South (JS) and Jaguar Northeast (JNE) deposits, demonstrating the continuity of the mineralisation within the current Mineral Resource model. New assay results include: 46.0m at 2.17% Ni from 128.0m including 23.2m at 2.82% Ni from 148.0m in JAG-DD-22-274 (JC). 49.3m at 1.20% Ni from 31.9m including 13.2m at 2.37% Ni from 53.5m in JAG-DD-22-262 (JC). 38.3m at 1.16% Ni from 87.7m in JAG-DD-22-246 (JS)…..

-

The Jaguar December 2021 Mineral Resource Estimate (MRE), comprising 80.6Mt @ 0.91% Ni for 730,700 tonnes of contained nickel, is already one of the largest nickel sulphide resources held by an ASX-listed company and the largest outside of the majors.

-

The next Mineral Resource update scheduled for Q3 2022 will underpin the Definitive Feasibility Study (DFS) and the Project’s first Ore Reserve estimate.

-

There are currently 15 rigs on site (13 diamond and two RC) drilling double-shift with the drilling currently focused on upgrading as much of the MRE into the Measured and Indicated categories as possible.

-

Centaurus is well-funded with cash reserves of approximately $65 million.”

TMC the metals company (TMC)

On May 9, the metals company announced: “The Metals Company provides Q1 2022 corporate update.”

On May 10 Mining.com reported:

The Metals Company deep-water tests polymetallic nodule collector vehicle in Atlantic…. “The pilot nodule collection system is so far performing beautifully throughout these trials and getting the collector vehicle into the deep water in the Atlantic has given the team the opportunity to really pressure-test critical components,” Gerard Barron, The Metals Company CEO said in a media release. Since 2019, Allseas and TMC have been working to develop a pilot system to responsibly collect polymetallic nodules that sit unattached on the seafloor and lift them to the surface for transportation to shore. Nodules contain high grades of nickel, manganese, copper and cobalt — key metals required for building electric vehicle batteries and renewable energy technologies…..The polymetallic nodule fields in the CCZ of the Pacific represent the largest known, undeveloped nickel resource on the planet.

Other juniors

Artemis Resources [ASV:ARV] (OTCQB:ARTTF), Australian Mines [ASX:AUZ] (OTCQB:AMSLF), Blackstone Minerals [ASX:BSX] (OTCQX:BLSTF), Cassini Resources [ASX: CZI], Class 1 Nickel and Technologies Ltd. [CSE:NICO] (OTCQB:NICLF), Electra Battery Materials [TSXV:ELBM] (ELBM) (Electra Battery Materials Park), Electric Royalties [TSXV:ELEC] (OTCPK:ELECF), Flying Nickel Mining Corp. [TSXV:FLYN], FPX Nickel [TSXV:FPX] (OTCPK:FPOCF), Grid Metals Corp. [TSXV:GRDM] (OTCQB:MSMGF), Group Ten Metals Inc. [TSXV:PGE] (OTCQB:PGEZF), Go Metals [CSE:GOCO] (OTCQB:GOCOF), Horizonte Minerals Plc [TSXV:HZM] [LON:HZM] (OTCPK:HZMMF), Inomin Mines [TSXV:MINE], Jervois Global Limited [ASX:JRV][TSXV:JRV] (OTCPK:JRVMF), New Age Metals [TXV:NAM] (OTCQB:NMTLF), Nickel Creek Platinum [TSX:NCP] (OTCQB:NCPCF), Pancontinental Resources Corporation [TSXV:PUC] (OTCQB:PUCCF), PolyMet Mining [TSX:POM] (PLM), Power Nickel [TSXV:PNPN] (OTCQB:CMETF), Renforth Resources [CSE:RFR] (OTCQB:RFHRF), Rox Resources [ASX:RXL], S2 Resources (ASX:S2R), Sunrise Energy Metals [ASX:SRL] (OTCQX:SREMF), Surge Battery Metals Inc. [TSXV:NILI] [FRA:DJ5C] (OTCPK:NILIF), Talisman Mining Ltd. [ASX:TLM] (OTC:TLSMF), Tartisan Nickel Corp. [CSE:TN] (OTCPK:TTSRF), Transition Metals [TSXV:XTM] (OTCPK:TNTMF), URU Metals Ltd. [LSE:URU] [GR:NVRA], Wallbridge Mining [TSX:WM] (OTCPK:WLBMF), Widgie Nickel [ASX:WIN], and Zeb Nickel Corp. [TSXV:ZBNI].

Note: Some of the above companies are covered in the Cobalt monthly news.

Conclusion

Nickel spot prices were significantly lower the last month and LME inventory was slightly lower.

Highlights for the month were:

- Update to Defense Production Act: US now expands definition of “domestic source” of battery raw materials to include UK, Australia, and Canada.

- Nickel market to swing to mild surplus persisting beyond 2022: Nornickel… the nickel deficit of 2021 should swing to a mild surplus of about 40,000 mt in 2022, albeit comprising mostly low-grade metal (from Indonesia).

- Severe global battery shortage likely post 2025, GlobalData forecasts, due to possible shortages of raw materials such as lithium, nickel, cobalt, and graphite.

- Goldman says bull market in battery metals is finished for now. Still, prices could soar again after 2024.

- Vale signs long-term nickel supply deal with Tesla.

- Nornickel received permission to retain its depository receipts programme until April 28, 2023. Nornickel says no material impact on palladium, nickel sales via sanctions…..and maintained its production guidance for 2022.

- Glencore own sourced nickel production of 30,700 tonnes was 5,500 tonnes (22%) higher than Q1 2021

- Sumitomo Metal Mining discontinuation of FS on the Indonesian Pomalaa Project. Increases CapEx for expansion of production capacity for cathode materials.

- ERAMET: Strong growth in Q1, 2022, boosted by higher nickel volumes and prices.

- Sherritt International Q1, 2022 adjusted EBITDA(1) was $58.5 million, Sherritt’s highest since Q3 2014.

- IGO Q1, 2022 delivers continued strong performance and remains on track to achieve full-year guidance.

- Nickel Mines signs binding agreement to acquire the Siduarsi Nickel-Cobalt Project in Papua, Indonesia.

- Mincor celebrates first ore through BHP Kambalda concentrator.

- Horizonte Minerals Plc breaks ground at the Araguaia Nickel Project in Brazil. Stage 1 target production of 14,500 tpa of nickel in 2024.

- Amur Minerals proposed sale of the Kun-Manie Project for US$ 105 million.

- Talon Metals releases record length of high-grade nickel mineralization at the Tamarack Nickel Project.

- St George Mining plans a major step-up in exploration to test new high-priority targets across four projects in WA.

- Canada Nickel announces new nickel discovery at Reid with larger footprint than Flagship Crawford Property Main Zone.

- Ardea Resources confirms high-grade nickel-cobalt from Goongarrie South metallurgical Drilling.

- Centaurus Metals’ Jaguar resource definition drilling delivers outstanding new results of up to 46.0m at 2.17% nickel from 128.0m.

- The Metals Company deep-water tests polymetallic nodule collector vehicle in Atlantic.

As usual, all comments are welcome.

[ad_2]

Source link

More Stories

First Automobile Works (FAW) – China’s Aggressive Electric and Hybrid Vehicle Manufacturer – Part 2

The Band Box Tavern

Advantages of Traveling by a Charter Bus