[ad_1]

Commonly talking the intention of lively stock selecting is to discover firms that deliver returns that are exceptional to the market normal. And while active stock picking requires threats (and involves diversification) it can also provide excessive returns. For example, the The Colonial Motor Enterprise Confined (NZSE:CMO) share price tag is up 35% in the previous 5 decades, evidently besting the market return of close to 12% (disregarding dividends). On the other hand, the far more latest gains haven’t been so spectacular, with shareholders attaining just 16% , such as dividends .

With that in thoughts, it is worthy of looking at if the company’s underlying fundamentals have been the driver of extended term effectiveness, or if there are some discrepancies.

Watch our newest evaluation for Colonial Motor

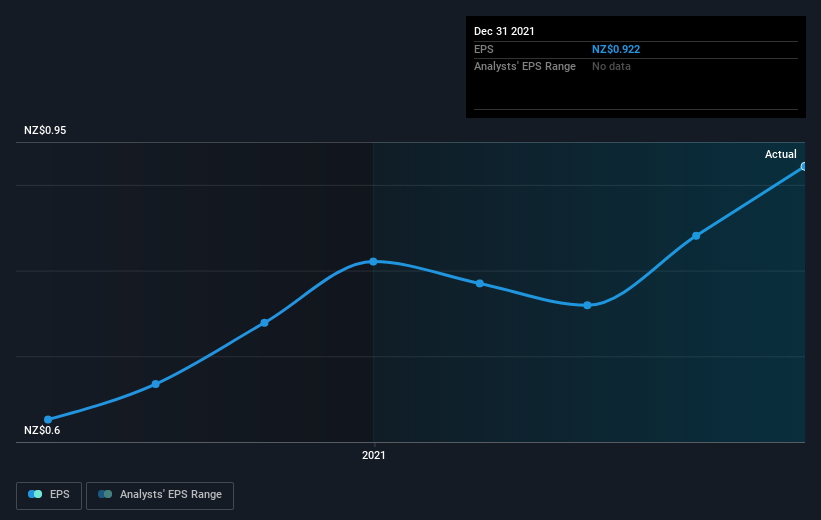

Even though markets are a potent pricing mechanism, share costs reflect trader sentiment, not just fundamental enterprise overall performance. A person imperfect but simple way to look at how the sector perception of a business has shifted is to look at the modify in the earnings per share (EPS) with the share rate motion.

For the duration of five many years of share selling price development, Colonial Motor achieved compound earnings for every share (EPS) advancement of 7.6% for every calendar year. The EPS progress is far more extraordinary than the annually share cost acquire of 6% over the exact period. So it appears the marketplace is just not so enthusiastic about the stock these days. The fairly reduced P/E ratio of 11.11 also suggests market apprehension.

You can see how EPS has improved around time in the impression down below (click on on the chart to see the precise values).

We like that insiders have been getting shares in the final twelve months. Owning explained that, most individuals look at earnings and profits expansion tendencies to be a far more significant information to the organization. This no cost interactive report on Colonial Motor’s earnings, profits and dollars move is a terrific location to begin, if you want to investigate the inventory even more.

What About Dividends?

As well as measuring the share price return, traders should really also take into consideration the full shareholder return (TSR). The TSR is a return calculation that accounts for the value of hard cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted cash raisings and spin-offs. Arguably, the TSR offers a more comprehensive picture of the return created by a inventory. We observe that for Colonial Motor the TSR more than the last 5 a long time was 83%, which is superior than the share price tag return described earlier mentioned. This is mainly a consequence of its dividend payments!

A Different Perspective

It is really wonderful to see that Colonial Motor shareholders have acquired a whole shareholder return of 16% around the last 12 months. That’s which include the dividend. That is far better than the annualised return of 13% over 50 percent a 10 years, implying that the corporation is executing superior recently. Offered the share cost momentum continues to be robust, it could possibly be really worth taking a nearer look at the inventory, lest you pass up an possibility. I find it extremely fascinating to seem at share value about the extensive expression as a proxy for enterprise performance. But to definitely gain perception, we will need to look at other details, way too. Consider for occasion, the at any time-present spectre of financial commitment risk. We’ve discovered 1 warning sign with Colonial Motor , and comprehending them ought to be component of your expense procedure.

Colonial Motor is not the only inventory insiders are acquiring. So get a peek at this totally free checklist of escalating firms with insider shopping for.

Please note, the current market returns quoted in this article replicate the market weighted normal returns of shares that at the moment trade on NZ exchanges.

Have suggestions on this short article? Concerned about the information? Get in touch with us immediately. Alternatively, e mail editorial-group (at) simplywallst.com.

This post by Just Wall St is typical in character. We provide commentary based mostly on historic info and analyst forecasts only working with an impartial methodology and our content articles are not supposed to be fiscal information. It does not constitute a recommendation to get or provide any stock, and does not just take account of your targets, or your fiscal problem. We aim to convey you very long-term centered analysis driven by fundamental details. Note that our assessment may perhaps not element in the hottest cost-sensitive company bulletins or qualitative substance. Only Wall St has no situation in any shares mentioned.

[ad_2]

Supply url

More Stories

Truck Accidents and Driver Fatigue – Accidents Waiting to Happen, Accidents That Can Be Avoided

Beetle Electric Car Conversion – Convert Your Old Bug Into an EV

Bedini Motor Generator – Power Your Home For Free With Bedini’s Genius Generator